Performance for Pay? The Relation Between CEO Incentive Compensation and Future Stock Price Performance

Research* last year clearly showed that there is clear evidence that Chief Executive Officer (CEO) pay is negatively related to future stock returns for periods up to three years after sorting on pay. For example, firms that pay their CEOs in the top ten percent of excess pay earn negative abnormal returns over the next three years of approximately -8%. The effect is stronger for CEOs who receive higher incentive pay relative to their peers and stronger for CEOs with greater tenure. Our results appear to be driven by high-pay related CEO overconfidence that leads to shareholder wealth losses from activities such as over investment and value-destroying mergers and acquisitions.

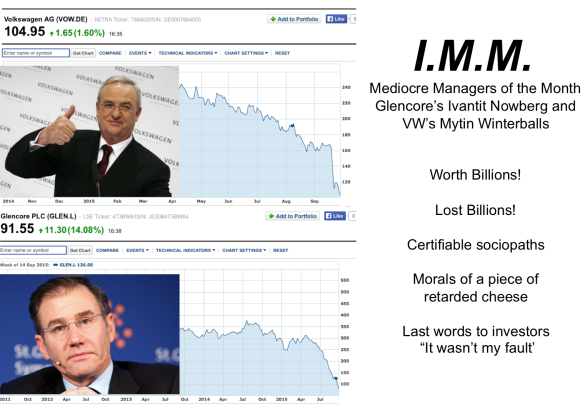

And in September we had two excellent examples of this with our two mediocre managers of the month being both overpaid and incompetent.

Our Membership Director at the Institute of Mediocre Management has asked me to reach out to other ‘C’ level executives who are also overpaid and out of their depth and who might needed friendly club where they can share their experiences with other like-minded buffoons. We have a lot of Bankers as you would expect and good representation from the construction and telephone sales industries and of course a couple of ‘charities’ but all are welcome. You need to have a pathological fear of Mr Corbyn, an exaggerated sense of one’s own importance and abilities, and also proof of significant tax avoidance. The latter is important so that if you ever ‘show and tell’ so will we (smiley face).

Do remember also that most Management Gurus such as dear Dickie Branson, Big Al Sugar and that plonker on Dragon’s Den tell us all that to succeed you need to fail first and then learn from that. Here at the I.M.M. we have many of the world’s leading business failures and most have never tasted success but it will surely come. However they continue to invest millions of investor’s money into their madcap schemes hoping that the law of averages will work to their favour.

So if your current package is gross, your litany of bankruptcies immense and your ego colossal then join us now at the I.M.M. Because you’re worth it!

*Michael J. Cooper, University of Utah – David Eccles School of Business, Huseyin Gulen

Purdue University – Krannert School of Management, P. Raghavendra Rau

University of Cambridge

One hears that the elective “Bilking your employer without being caught” introduce by IMM is in great demand.

LikeLike

Absolutely and also here at the I.M.M. we do not condone fraud, mismanagement or misleading customers, we actively encourage it…..

LikeLike